Menu

ARIMIO PSP

PayTech edge

Your Primary Payment Service Provider

Unlock cutting-edge financial solutions with ARIMIO Payment Service Provider (PSP)! We deliver secure, efficient, and tailored online financial services suitable for individuals and businesses alike.

Experience a wide array of payment options, including fast and reliable P2P, C2A, and A2C transactions with Mastercard and Visa. Whether you're looking to manage high-volume transactions or require bespoke payment solutions, our PSP is designed to meet the diverse needs of modern commerce.

Elevate your financial interactions with our top-tier payment services - start transacting smarter today!

Financial Flexibility

Elevate Your Payment Experience

Global Payment Methods

From credit cards and e‑wallets to bank transfers and cryptocurrencies, we've got your transactions covered

Emerging Markets Entry

Our services are designed to connect you with prospective markets in growing regions, opening doors to untapped potential

Multi-Currency Accounts

Conduct global transactions in various currencies smoothly, avoiding the hassle of multiple exchange rates

Instant Payment Processing

Enjoy the efficiency of instant payments, with fast and seamless fund transfers boosting your financial operations

PSP Insights

Evolution of PSP: Meeting Market Demands

As digital economies surge, Payment Service Providers (PSPs) become crucial for meeting the growing market demands. With the global PSP market projected to soar past $190 billion by 2028, as reported by Grand View Research, the pivotal role of PSPs in facilitating secure and effortless online transactions is more apparent than ever. Moreover, a McKinsey & Company report highlights the expanding prevalence of online payments, with PSPs leading the way in enhancing transaction security and user experience.

ARIMIO PSP responds to these trends with flexible, versatile payment solutions that are tailored to your business needs, keeping you ahead in the fast-evolving digital payment landscape.

KEY BENEFITS

Secure, Quick, Transparent and Effortless

Chargeback Protection

Gain reliable protection against chargebacks, minimizing risks and ensuring financial stability for your business

Fast Integration

Experience express and straightforward setup, enabling you to start accepting online payments in just a few simple steps

Clear Cost Plus Prising

No hidden fees, no surprises. What you see is exactly what you pay, promoting transparent and straightforward billing

Effortless Control

Manage user accounts with ease, customize access for employees, and track all payment activities with our detailed reports

READ FAQ

General Questions

QWhat is the difference between a Payment Service Provider and a Payment Gateway?

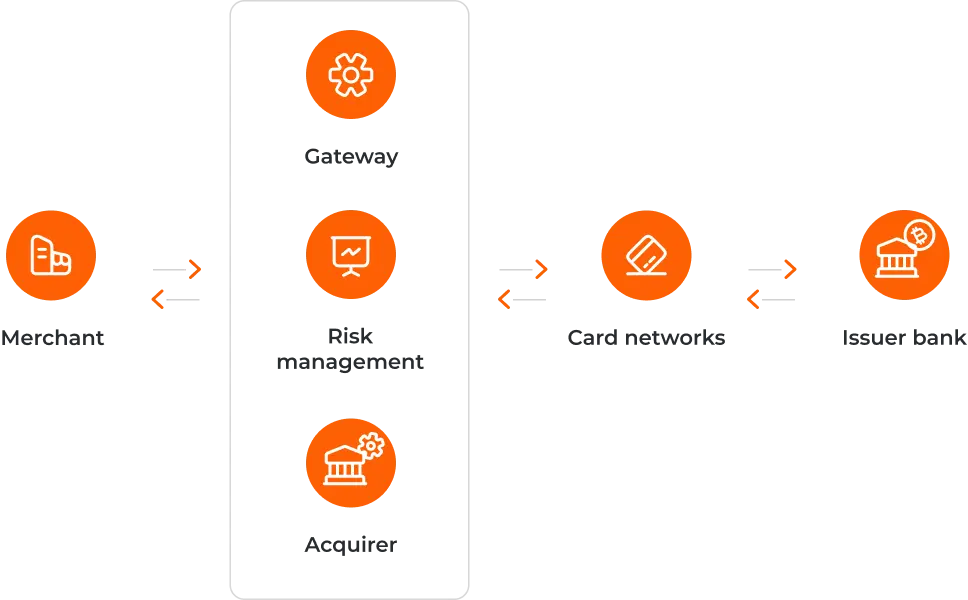

A Payment Service Provider (PSP) delivers a comprehensive suite of services for managing electronic payments, including processing transactions, detecting fraud, and generating detailed reports. In contrast, a Payment Gateway specifically manages the secure transmission of payment information from the customer to the merchant’s bank. While a PSP incorporates the functions of a payment gateway, it also provides additional features and support to oversee the entire payment process

QDoes ARIMIO PSP provide support with Mastercard and Visa payments?

Yes, ARIMIO PSP accommodates a wide array of payment methods, prominently including Mastercard and Visa. This ensures all users experience maximum flexibility and convenience for conducting their payment transactions.

QCan ARIMIO PSP handle peer-to-peer (P2P) payments?

Absolutely. ARIMIO PSP facilitates P2P transactions, along with Consumer-to-Account (C2A) and Account-to-Consumer (A2C) payments. This versatility addresses an extensive spectrum of payment requirements, making it suitable for a variety of user needs, from individual transactions to business operations.

QHow does ARIMIO PSP maintain transaction security?

ARIMIO PSP utilizes state-of-the-art security technologies, including robust encryption and thorough fraud detection systems, to safeguard your financial data and guarantee safe transactions.

QHow easy is it to integrate ARIMIO PSP into my existing systems?

ARIMIO PSP provides clear and concise API documentation along with dedicated support, making the integration of our payment services into your websites and applications both quick and straightforward. This approach minimizes disruptions and simplifies the overall implementation process.